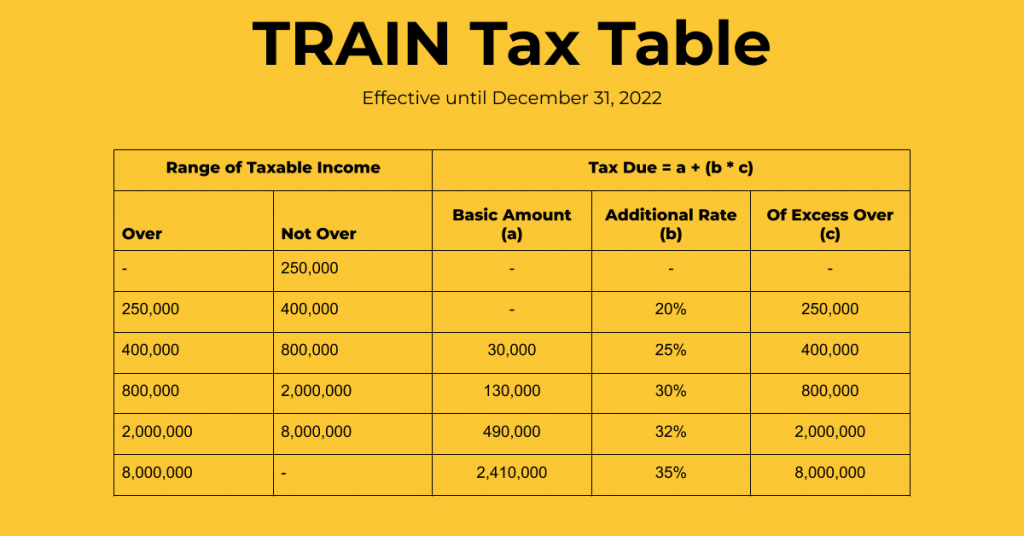

Train Law Tax Table 2025 Philippines. Use the bir tax table in 2025 to determine the tax rate applicable to your taxable income. 30 jul 2025 1 min read.

January 1, 2025 until december 31, 2025:. To estimate the impact of the train law on your compensation income, click here.

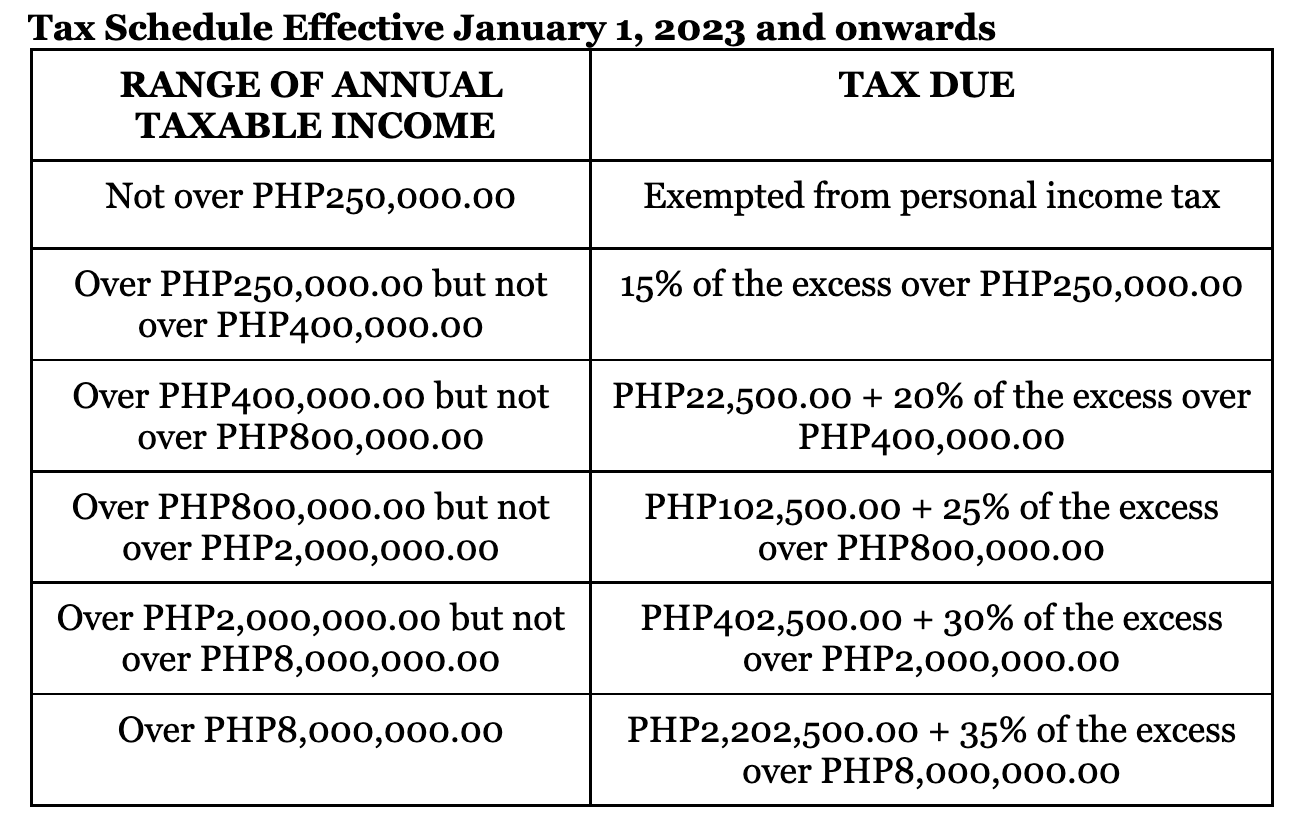

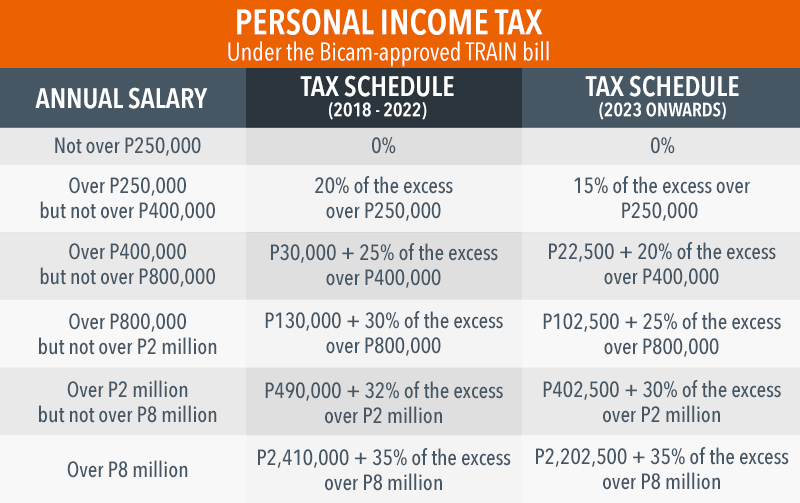

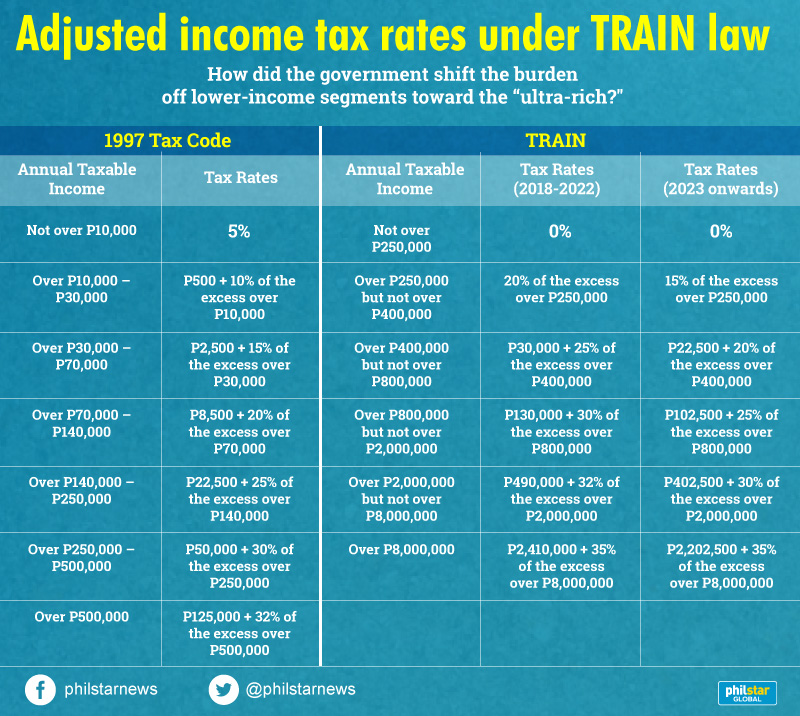

Individuals with an annual taxable income below php250,000 are still exempted from paying personal income taxes under the adjusted tax.

10+ Calculate Tax Return 2025 For You 2025 VJK, Please enter your total monthly salary. Individuals with an annual taxable income below php250,000 are still exempted from paying personal income taxes under the adjusted tax.

tax rate philippines 2025 Olin Barone, Tax schedule effective january 1, 2025 and onwards. Individuals with an annual taxable income below php250,000 are still exempted from paying personal income taxes under the adjusted tax.

BIR withholding tax table 2018 Tax table, Withholding tax table, Tax, This article shows the new tax table with downloadable excel versions. How much is your new income tax under the train law for 2025?

BIR Tax Schedule Effective January 1 2025, Bir issues first circular on the revised withholding tax table implementing ra 10963. Tax schedule effective january 1, 2025 and onwards.

Effect of Train Law in the Philippine Tax TAXGURO, Individuals with an annual taxable income below php250,000 are still exempted from paying personal income taxes under the adjusted tax. Under the tax reform for acceleration and inclusion (train) law, filipino employees earning an annual income of more than ₱250,000 are required to pay taxes.

Tax Refund 2025 23 Timeline TAX, To estimate the impact of the train law on your compensation income, click here. New tax rates based on ra no.

The Accountant's Journal 2018 Train Law The New Tax Table, The table consists of different tax brackets with corresponding tax rates. Train law tax table 2025.

How to Compute Withholding Tax Based on the Newly Enacted TRAIN Law, Train law to take effect next year, taxpayers urged to participate in discussions to. New and update 2025 bir tax table from train law.

Highlights of Tax Reform Law (TRAIN) See the Tax Rates for 2019, New and update 2025 bir tax table from train law. Individuals with an annual taxable income below php250,000 are still exempted from paying personal income taxes under the adjusted tax.

Winners and losers How the TRAIN law affects rich, poor Filipinos, The revisions to the train law now decree that employees earning solely from compensation income and have a total taxable earning of less than 8 million yearly. Please enter your total monthly salary.